Danmarks Nationalbank (DN) has carried out an analysis of the role of cash in a low cash usage society.

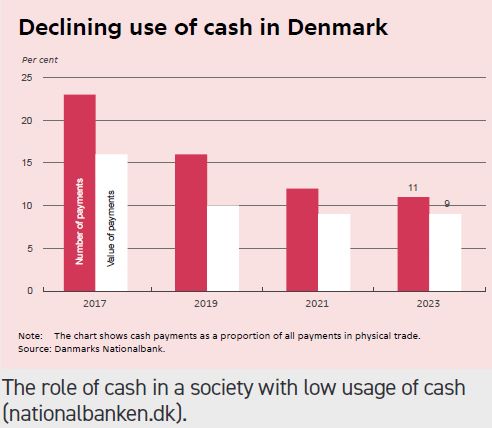

10% of payments are still made in cash, and there are groups in society for whom cash is important, whether out of necessity or choice.

At the same time, technology continues to evolve, both technology to defend banknotes against counterfeiting as well as that available to counterfeiters. The result is that the central bank is to make changes to the currency.

DN is clear that Denmark’s banknotes need to change in order to keep them. The change will happen in two parts. First, at the beginning of 2024 and in 2025 DN will issue upgraded versions of the current 2009 DKK 50, 100 and 200 Danish bridges and archaeological finds series. Although in 2020 an upgraded DKK 500 was issued, from 31 May 2025 only the 2009 series will be legal tender.

Second, in 2028-29 a new banknote series will be issued. In Spring 2024, the bank will start a consultation on the themes to be used in these banknotes.

As part of these changes, from 31 May 2025 Denmark will stop issuing and using the DKK 1,000 denomination. Therefore, the 2028-29 series will not include a DKK 1,000. Citizens have until 31 May 2025 to return these notes to their banks but will be able to exchange them at the DN itself up until 31 May 2026.

DN does not regard a DKK 1,000 as necessary to support safe and efficient payments. Its analysis shows that most payments are for a value less than DKK 500. The financial sector and retailers have said they want it phased out so they can hold less change in their tills and to make cash handling easier.

Anti-money laundering rules impose limits on the size of cash transactions. Retailers may not accept more than DKK 20,000 in cash and payments over DKK 8,000 must be reported to the tax authorities. The police tell DN that the DKK 1000 is used to support financial crime. While counterfeiting levels remain low, DN has observed increasing numbers of attempts to counterfeit the DKK 1000.

DN has also made the statement that it makes sense to ease Denmark’s ‘cash obligation’ to support secure and efficient payments.

The cash obligation, as it is known, came about when, in 1984, Denmark introduced Dankort, a national card payment scheme. To ensure there was competition, the Danish Payments Card Act was introduced in the same year. This required retailers to accept cash, although there are exceptions for remote trade, including internet trade and self-service environments.

Businesses don’t have to receive cash from other businesses. Staffed stores do not have to accept cash between 22.00 and 06.00.

DN has also said that, for now, there is no need to impose an obligation on banks in relation to their cash services. However, while current adjustments to the cash infrastructure are occurring in line with declining cash use, any further adjustment must happen without impairing access to cash and cash services.