At the end of 2011, the Netherlands had 2,654 bank branches. At the end of 2021 this had fallen to 726, and not all of those provided over the counter cash services. At the same time, more than 4% of retailers now inform customers that they don’t accept cash.

In response to this, and other cash cycle challenges, the Netherlands has a Cash Covenant signed by stakeholders in the cash cycle to make sure cash is accessible. The Dutch National Bank (DNB) has carried out a study to help the action plan for accessible payments of the National Forum on the Payments System (NFPS) 1. It has also reported on a study into the state of cash acceptance in shops and other retail outlets in the Netherlands. Both reports are covered here.

In its report of the study, entitled ‘Digitalisation of the Payment System: a Solution for Some, a Challenge for Others’, the DNB set out to identify issues specific customer focus group members face and look for possible solutions to feed into the NFPS, its aim being to improve banks’ existing accessibility initiatives and to promote public awareness of them.

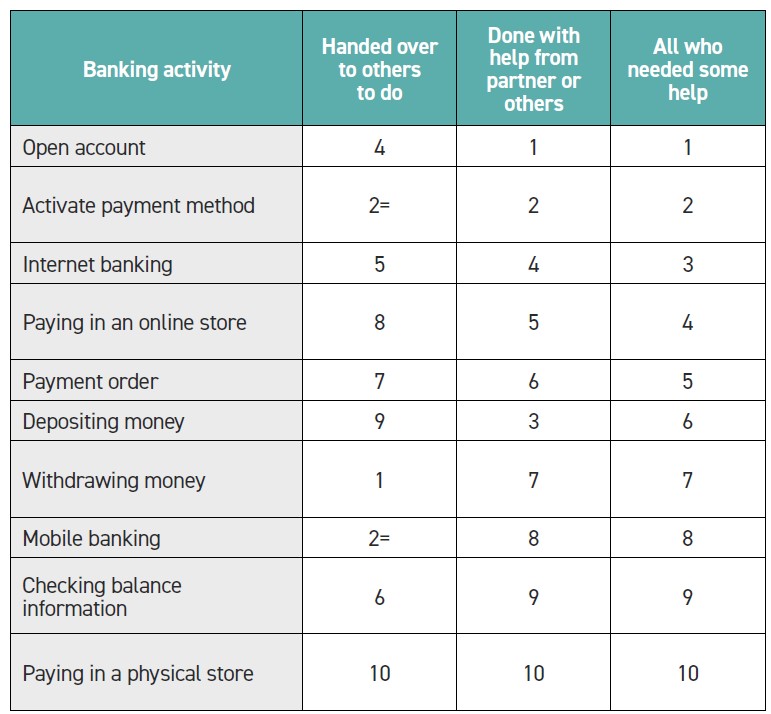

The study found that about 2.6 million over 18 year olds in the Netherlands struggle with their digital and other banking affairs. While the majority can manage day-to-day payments independently, people are less autonomous when it comes to less frequent banking actions such as opening a bank account or blocking a debit card. In addition, 400,000 people were totally dependent on others for paying bills and their banking arrangements.

With one in six adults not able to do all banking activities on their own, it is important to understand the barriers causing them problems. Generally, the key issues, whether on an app, using an ATM or at point of sale, were:

Over complicated language

Difficulty remembering codes

Stress when under time pressure.

In addition, difficulty reading, physical or mental disabilities, the Dutch language and having no internet connection were also factors.

Specific obstacles for some focus groups included:

ATMs being too high. This was relevant for those in wheelchairs and those with limited hand functions.

No voice operations or headphone jacks for blind people to use.

Screens timing out for people who can’t read fast enough.

Having to travel long distances to access ATMs or branches.

ATMs not having low denomination notes available, important for those on low incomes.

Banking apps presented specific problems, particularly for those who can’t read or are physically disabled. Complex language makes things harder and time limits cause problems.

The study explored a range of different solutions and how willing people might be to try them. The shares were:

Personal telephone customer service: 75%

Permanent contact person at the bank: 65%

Service point: 61%

Bank bus: 46%

Classroom lessons: 34%

One to one help at home: 32%

Some of these already exist in at least some form, but awareness was low. Only 38% were aware of local service points, senior lines (for the 107 people in the study who were over 65s) 30%, 18% courses and information meetings, financial care coaches (by phone, video or home visits) 17%.

The study concludes by highlighting the opportunity to learn from this feedback, including more work on explaining what is available now. Given the clear evidence that going digital is a struggle for a significant number of citizens, this is important work.

Separately, the DNB has warned that too many retailers are refusing cash payments, making it more difficult for people to make purchases and reducing the usability of note and coins The DNB, which monitor cash developments and use annually, commissioned research firm Locatus to visit more than 4,300 shops and other retail outlets throughout the Netherlands in late 2022 to take an inventory of payment notices on signs and stickers.

On average, 4% of retailers clearly state that they only accept debit card payments, but in some specific sectors, the share is much higher. About one in five cinemas refuse cash, and more than 10% of pharmacists have stopped taking cash payments, the DNB said, based on research by Locatus. It is also relatively difficult to pay with cash at parking garages and lots.

Moreover, in a third of the shops where customers can only pay by card, the retailer only makes it clear once customers are at the checkout. The DNB was emphatic in saying that it must be clear in advance that shops do not accept cash, for example, with signs saying only specific cards may be used for transactions.

In general, the share of debit card-only retailers increases as cities get larger. In places with more than 175,000 inhabitants, about 6% of retailers only want debit card payments. In villages with fewer than 10,000 inhabitants, the average falls to about 2%.