Anikó Bódi-Schubert and Ágnes Illés Belházy have provided a short summary of the content of the new Magyar Nemzeti Bank (MNB) regulation on the processing and distribution of banknotes, its main motives and its expected impact on domestic cash payments.

The amendment of the Magyar Nemzeti Bank (MNB) Banknote Decree was issued in Hungary in January 2023. It dealt with the processing and distribution of banknotes, and on technical tasks relating to the protection of banknotes against counterfeiting. The new provisions include a minimum requirement for the number of ATMs operated by commercial banks.

Commercial banks and branch offices with operating licence in Hungary are all subject to the new regulation, which sets the number of ATMs to be operated by commercial banks primarily on the basis of the number of payment cards with cash functionality issued by the credit institution. The number of cards issued is defined as the total number of debit cards plus credit cards issued less a weight of 0.5.

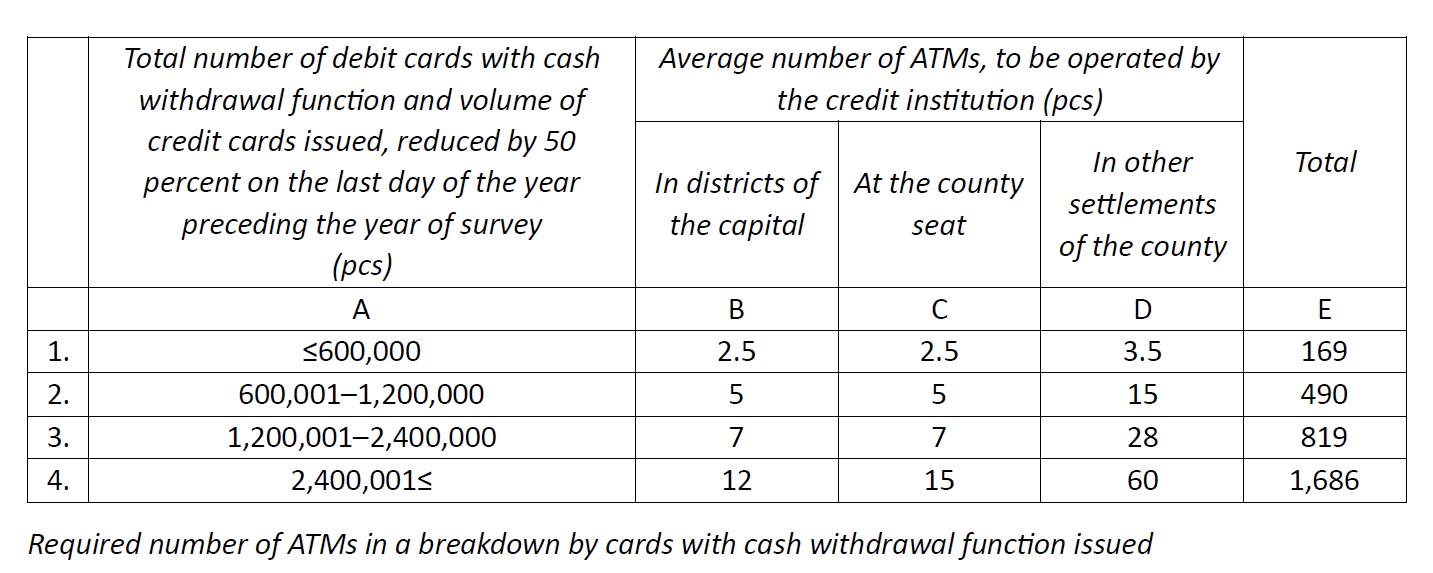

On the basis of this indicator, the MNB has defined four categories, and for each of these four categories it sets an expected average number of ATMs available per three groups of settlements (districts of the capital, county seat, other settlements in the county). The table below presents the details.

In addition to the above, the regulation also stipulates that credit institutions issuing bank cards in the range of between 600,000 and 1,200,000 and more than 1,200,000 must operate ATMs in at least 65% (214 towns) and 80% (263 towns), respectively, of the towns other than county seats.

As well as territorial coverage, average annual cash withdrawal turnover per ATM and average annual deposit turnover per ATM with a deposit function must not exceed the benchmark values set by the MNB. These benchmarks are established on the basis of previous years’ ATM cash withdrawal and deposit turnover, with the current values averaging HUF 2.3 billion per ATM per year (€5.9 million) for cash dispensing machines and HUF 3.25 billion per year (€8.3 million) for deposit machines.

The provisions on the ATM infrastructure were introduced after months of preparation and impact analysis, and after several consultations with the credit institutions concerned. Given the heterogeneous nature of the Hungarian banking sector, the degree of adaptation following the regulation is not uniform across the participants concerned. There are banks with a significant network that are already in compliance. For credit institutions that need to expand, network upgrades must be completed by 2025.

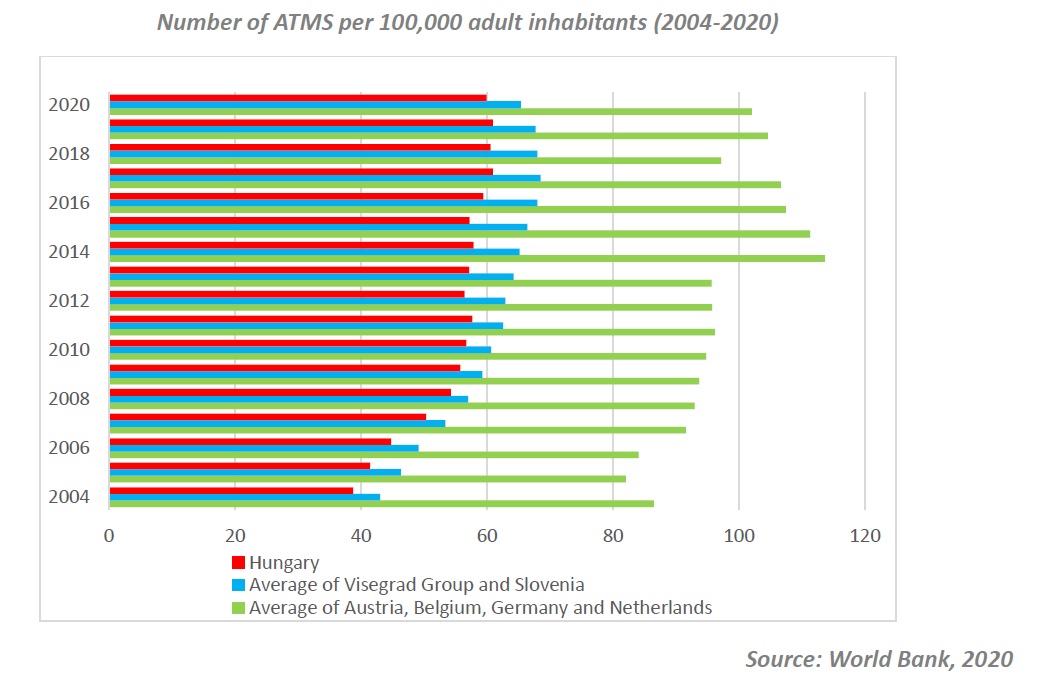

In international comparisons, the level of ATM coverage in Hungary is significantly lower than in countries with similar cash usage habits and of a similar size. This is clearly illustrated by the number of ATMs per 100,000 adult inhabitants, which is much lower in Hungary than the average of some Western European countries, but also below the average of the Visegrad countries (Poland, Czech Republic, Slovakia) plus Slovenia.

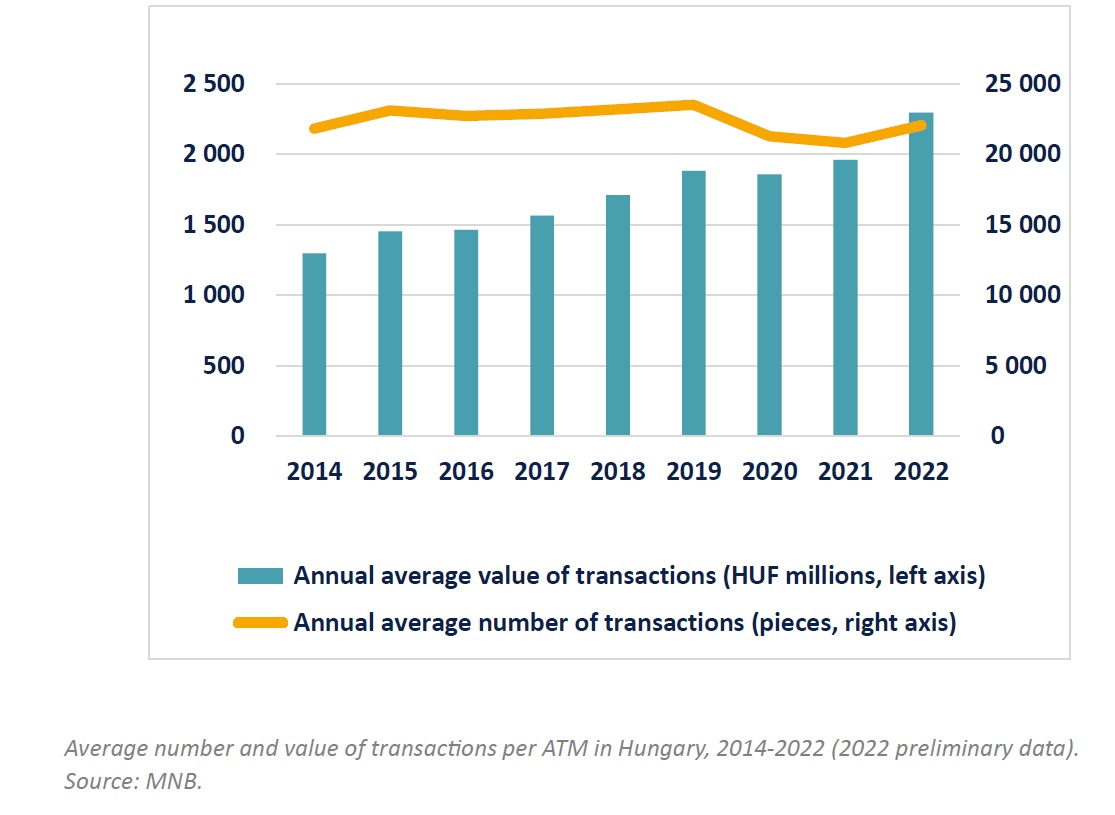

Although the total number of cash withdrawals has been falling for years, the value of cash withdrawn from teller machines, apart from the transitional period of COVID-19, has been rising continuously. As a result, the value of cash withdrawals per equipment exceeded HUF 2 billion (€5.1 million) by 2022.

With the emergence and spread of ATMs capable of accepting cash payments, there has also been a rapid increase in the number and value of deposit-type transactions. In 2022, the total value of cash withdrawn from ATMs operated by commercial banks exceeded the previous year’s level by 12.7%, reaching a total of HUF 8.721 billion (€22.36 billion), while deposits through ATMs amounted to HUF 2.553 billion (€6.55 billion), up 28.3% on a year earlier.

As a result of an increase in the value of cash withdrawals against a backdrop of declining transaction numbers, the average value per ATM cash withdrawal increased by around 30% between 2019 and 2022 to reach HUF 95,000 (€252), which is an exceptional figure by international standards.

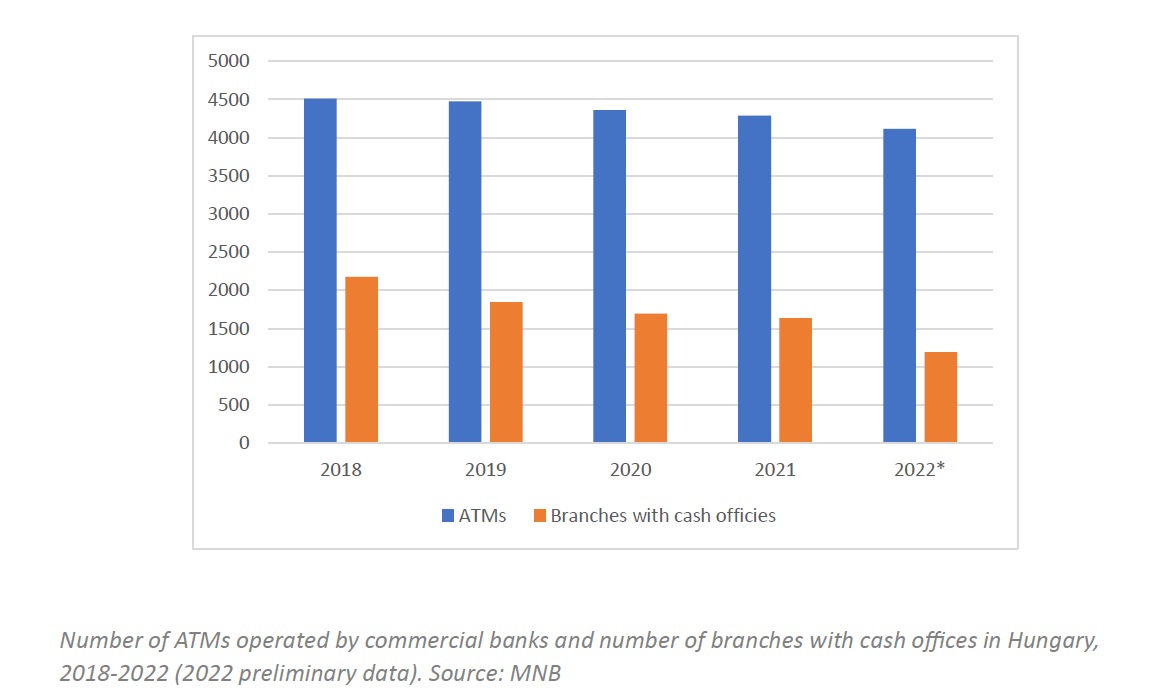

Primarily to meet cost reduction criteria, Hungarian commercial banks have been continuously slimming down their ATM networks in recent years, which has led to an increase in the network load as turnover has kept growing.

Another development contributing to the increase in the cash network load has been the fact that branch closures, the termination of cash offices in branches and the reduction of the opening hours of cash offices have increasingly limited the opportunity for customers to use cash services. This has also led to a steady increase in the social cost of cash payments as, for example, it takes more time and higher transport costs for the public to make transactions in cash, due to the scarcity of network resources.

The cash infrastructure load has therefore been increasing steadily for years, as growing turnover has to be serviced by a shrinking system, which can lead to network overload. An overstretched infrastructure is also less resilient to shocks than a network with adequate reserves and optimal utilisation.

This scarcity of network resources can be particularly detrimental to already vulnerable social groups such as the elderly, people on low incomes and those living in settlements located far from county seats.

Taking all these into account, the aim of the MNB’s regulation is to ensure that in the design, maintenance and operation of the Hungarian cash infrastructure network, the security of supply and fair access to cash for the public are also taken into account, in addition to the operators’ business policies and cost-efficiency considerations.

This, says the MNB, should lead to a more equitable national cash network in terms of social cost allocation and a robust national cash network in terms of the security of supply.