At the online Future of Cash conference last month, Diederik Bruggink from the European Payment Council (EPC) presented its thoughts on how to make cash more efficient.

The EPC wants to increase recirculation, shortening and speeding up the cash cycle, and to reduce manual handling and redundant processes. To encourage this, it wants unnecessary hurdles to the distribution and recirculation of banknotes to be removed, and existing regulations to be either extended or moved to follow a more risk-based approach. It wants to achieve a reduced central bank physical presence and involvement while still achieving affordable access to fit and genuine cash.

The EPC is a not-for-profit organisation that is the focal point and voice for European Payment Service Providers (PSPs). It supports and promotes European payments integration and development on behalf of its members that deliver the Single European Payment Area (SEPA) payment schemes, about 40 billion transactions across 36 countries each year.

Although PSPs deal with credit transfers, direct debits, cheques, e-money and all of the different card types, its members also handle cash. Cash is a major cost for PSPs and so the EPC has created a Cash Efficiency Working Group (CEWG) to formulate policies to increase efficient cash handling and to make recommendations about the sharing of best practices.

The presentation started by showing 2019 data on the number of cashless transactions and cards per capita across the euro area, the number of transactions ranged from 548 in Finland to 125 in Italy, with the European average being 286. 11 countries were below the average, eight above, Spain, Italy and Greece were amongst those below the average. The data demonstrated the diversity in the continent.

Similarly, the average number of cash transactions per person per day ranged from 1.6 in Greece, Portugal and Italy to 0.5 in Finland and Estonia. Only the Netherlands, Finland and Estonia had more card transactions than cash transactions. The euro area average was 1.1 cash and 0.4 card transactions. Only six countries had more than 0.4 card transactions. This data reflects that, in 2019, cash remained the most used payment tool by some margin.

Two charts demonstrated the paradox of growing demand for cash while, at the same time, the number of bank branches and ATMs declined. The CAGR for the number of euro banknotes 2015-2019 increased 6.2% and as a % of GDP increased by 1.3%. The number of bank branches fell 4.6% and ATMs 0.7%, CAGR.

Recirculation close to the point of use offers cost savings to banks from less cash movement. It also reduces both the opportunity for crime and the environmental damage done by transport-related CO2 emissions.

Whether local recirculation happens starts with the cash usage patterns of the country. It also depends on a range of factors starting with the flexibility allowed by the central bank, including by retailers. Central bank rules put in place around off-balance sheet cash holdings play an important role in incentivising recirculation.

One element which the presentation focused on was the relative density of cash services made available both by the central bank and the banks, their opening hours and ease of access. In the case of the banks, this covered how many ATMs, bank branches and cash centres they have, how these are distributed and what their policies are for allowing the public and other organisations to use them as well.

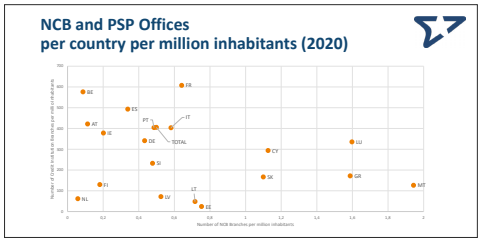

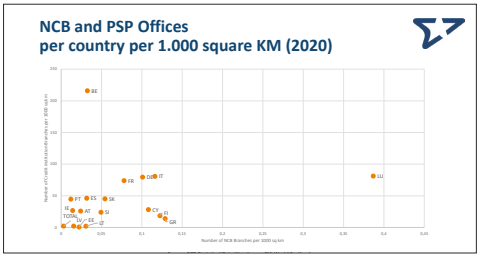

Two charts were shown, one the number of central bank and PSP offices per country per million inhabitants and, secondly, their number per 1,000 km², based on 2020 data.

The first chart showed the diversity across the Eurosystem of the networks, with no clear logic guiding why it is like it is.

Again, the second chart, although with some clear groupings, did not reflect a guiding principle to understand the result.

A table compared 2018 and 2020 banknote circulation data to see if it could act as a proxy for the possible evolution of banknote circulation. Although the €500 data (now no longer issued but with the €200 being used as a substitute) was distracting, it showed that the number of notes being returned to the ECB fell overall by a third across all denominations, other than the €200, suggesting a strong increase in recirculation.

The number of notes checked for authenticity and fitness has fallen steadily, if slowly, over the last few years - 32 billion notes in 2016 to 30 billion in 2019, with 5 billion of them being categorised as unfit. The growth in banknotes checked by credit institutions and other professional handers has increased only slightly more quickly, growing from 33 billion in 2016 to 38 billion in 2019. It is this rate of change which the EPC is seeking to change.

To shorten the cash cycle, the EPC has made a number of suggestions. These start with the central banks themselves, asking them why they don’t store their own banknotes at PSP or Cash in Transit (CIT) cash centres? Could the destruction of unfit notes be delegated as well? Central banks should encourage recirculation, including inspecting level 2 and 3 security features, using auditing and testing regimes to licence and approve operators.

It suggests that national central banks (NCBs) ‘match’ cash so that PSPs exchange cash denominations between themselves, with settlement taking place via central bank branches (TARGET 2). This would reduce cross border shipment of banknotes.

Within borders, central banks could set rules that restrict the ordering and depositing of the same denominations by the same cash owners within a period of time. This would discourage moving cash for short periods of time and could encourage ‘matching’ between PSPs and CITs.

In order to encourage investment in cash recirculation machines, retailers should be allowed to replenish ATMs, under specific security requirements and regulations. Perhaps large retailers could allow small retailers to deposit cash at their facilities. The EPC wants hardware suppliers to improve the reliability and performance of their equipment and to supply it at a lower cost.

The final suggestion floats the idea of having a ‘smart national location policy for offering cash services’. The idea is that local recirculation does not only need to happen at PSP branches, but could also happen in public and private (retailer) areas, subject to appropriate safety measures.

The Euro Retail Payments Board (ERPB) fosters the integration, innovation and competitiveness of euro retail payments. Chaired by the ECB, and with members from both the demand and supply sides of the market, NCBs and a European Commission observer, in November 2020 the ERPB launched a Working Group on Access and Acceptance of Cash. The goal is to safeguard legal tender cash as a widely accepted and available means of payment. By achieving this, it wants to prevent the need for regulatory measures to address shortcomings in the cash cycle.

Its first task is analysing and reporting on the current cash service levels for consumers and businesses and to identify gaps.