Stefan Hardt, Chief Cashier of the Bundesbank, posed this question at the recent Intergraf Currency+Identity conference in Milan. Ironically, this comes just as the Bank of England appoints Victoria Cleland to have a combined role of being Executive Director for Payments and Chief Cashier. Sarah John, the current Chief Cashier, is moving to be the Bank’s Chief Operating Officer.

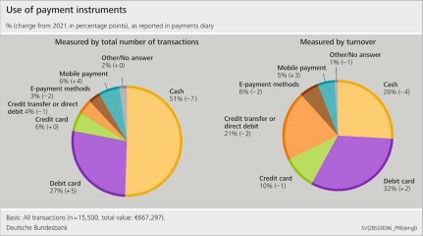

Mr Hardt discussed this question in the context of declining cash usage. Surely, less to do, therefore? In Germany cash still makes up roughly 50% of the number of payments, although the share of transactions paid with cash fell by 32 percentage points between 2008 and 2023. The rate of decrease has accelerated since the pandemic.

At the same time, the number of bank branches has fallen significantly, from 41,700 in 2008 to 20,900 in 2023, 50% less. The number of ATMs and Cash Recycling Machines has fallen 9% from 56,000 to 51,000.

The Bundesbank has considered three different future scenarios, a hyper digital payment world, a cash renaissance payment world and a vanishing hybrid payment world (the one we are in right now).

Faced with this uncertain world, the Bundesbank wants to maintain freedom of choice, protect vulnerable groups and ensure that in a crisis the cash supply is certain. It sees Germany as being in a downward spiral and that this spiral needs to be broken.

The spiral consists of a reduction in cash sources leading to an increase in the effort it takes to obtain cash, which means less cash is used and there is less frequent use of the places where cash is sourced. The result is the unit cost of cash rises, and the number of cash sources is reduced. And so, the cycle restarts.

Changing the paradigm In response, in February 2024 the Bundesbank created the National Cash Forum involving stakeholders throughout the cash cycle. Their role is to develop recommendations and best practice to provide better visibility of cash in public and politics.

Currently the Bundesbank has 31 branches with 125 banknote processing machines. It is moving to a future branch structure of 23 branches, closing branches with low capacity utilisation, those needing refurbishment and those which are close to other branches.

This future-oriented, needs- based adaptation of the branch network will mean the creation of some new buildings and the closure and refurbishment of old buildings. Digitisation and automation will be a key part of this change.

New buildings are needed to ensure appropriately located, sized and organised branches for a high demand future. They will maintain vault space and cash handling capacity. They will be designed for automation, improved ergonomics, accessibility and environmental considerations. Refurbishing existing buildings will be expensive.

Stuttgart, Hanover, Frankfurt and Cologne will get new standardised branches.

Ludwigshafen, Osnabrueck and Ulm branches will close in 2028. Between 2034 and 2039 another five branches will close.

It would appear that in Germany at least, being Chief Cashier is not a part- time job.