At the recent Cash Sustainability Forum, held in Frankfurt last month, Ian Woolford, Head of Money and Cash at the Reserve Bank of New Zealand, gave a presentation on the country’s impending community cash services trial.

New Zealand is a big country with a small population, meaning delivering cash services is a challenge. If laid over Europe, it would stretch from Copenhagen to Marseille but with a population of only 5.1 million people.

Cash usage has been in decline for some time. As a proportion of household payments, cash payments have fallen from about 32% in 2007 to 7% in 2023. Despite that, when surveyed the population overwhelmingly supports cash. A ‘say-do’ gap clearly exists. 6% of the population is entirely reliant on cash. A key point, that isn’t properly appreciated, is that people become vulnerable at different times in their lives.

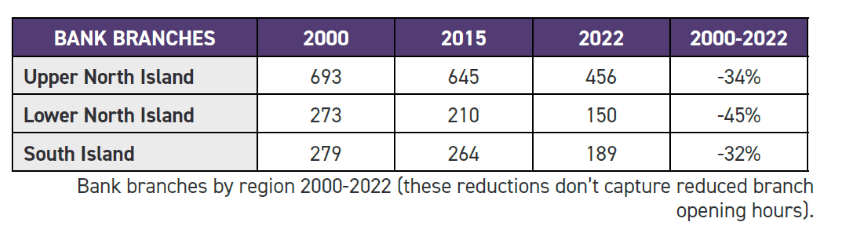

While the decline in the number of bank branches started a long time ago, it has accelerated sharply since 2015.

The number of ATMs supplied by banks has also fallen. In 2011 there were about 2,500 bank ATMs, and this number persisted at that level until 2017, declined slightly to 2019 and today is just over 2,100. Pay-touse ATMs provided by independent suppliers has largely filled the gap.

New Zealand’s banks have conducted an aggressive anti-cash campaign in recent years and have done this quite openly. The branch and ATM closures are part of this strategy.

The public still get access to cash through bank owned ATMs, but 34% of cash is now accessed through merchants.

The problem is that the retail cash sector, merchants, independent ATM operators and consumers, are carrying 68% of the costs (and risks) of cash – providing cash, change, running the independent ATMs and the costs of storing and managing cash outside of banks. The commercial banks supply the cities but have left the retailer cash sector to do the rest.

The community cash services trial described in this presentation is being carried out in the context of RBNZ’s 2021 cash system redesign.

In 2021 RBNZ set out to ensure that consumer access to and use of cash is supported, and merchant acceptance of cash is supported. It has run consumer awareness campaigns, mandated merchant acceptance and put in place remuneration of merchants for cash out services. The key is frequent, affordable cash delivery and collection for merchants.

RBNZ is working to find solutions for:

No single intervention will work, and a range of interventions will be needed.

RBNZ has identified 91 communities with a population of between 1,000 and 10,000 people that don’t have a branch or only have very limited opening hours. 8-10 of these have been chosen for a trial starting in September 2024, and running through to February 2026, which will make cash available through retailers on a new basis.

The cash flow will be from cities to rural depots and from those rural depots to rural shops which will then provide cash, with or without purchases, to consumers with no fee. Retailers will be paid a fee for cash issued by them.

In these communities there will be one of:

The costs of this equipment is being paid by the trial.

The ATM industry says recycling ATMs reduce CIT visits by 40%. The trial will test whether this new access to cash changes behaviour, the economics of local distribution, recycling within communities and banknote quality impacts, service needs and use rates.

Beyond the trial there is a need to explore legal gaps, including other parts of the cash system, the redesign ‘policy bundle’ described above, the implications and practicalities of widespread remuneration if the trial is successful and how to manage crisis using this approach.

The results and lessons from this trial will be watched closely because it is a rare example of a focused attempt to address the withdrawal of cash services in rural areas. The rest of the 2021 redesign are also of great industry to the wider cash community.