If a general can choose the battlefield, they can shape what happens next in the fight that follows.

At the Future of Cash conference Brett Scott, the author, explained how the digital leaders have created and driven the story that digital is good and analogue is bad. He used the work of Visa and Mastercard in the payment landscape to illustrate what has been done, and to challenge the audience to think about regaining control and changing the conversation.

The digital narrative plants some key ideas in our heads which, once heard, are hard to unhear.

Lead the way. Keep up.

‘Don’t be ‘left behind.’

Save ‘them’ from being excluded.

Don’t ‘delay’.

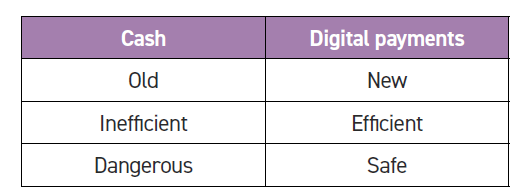

Alongside this goes what Brett termed the ‘upgrade’ myth, that the move from cash to digital payments is an inevitable evolutionary step. Cash is the ‘horse and cart’ of payments, so those who like cash need to get out of the way of young people. Ordinary people are demanding it, consumers are demanding it.

The language used is of a ‘race to cashless’ and the headlines reflect this, eg. ‘Sweden leads the race to become cashless society’. ‘Which European country is winning the race to become completely cashless?’, ‘Vietnam, Japan and Thailand are still behind in the race for cashless payments’, ‘The race towards a cashless Africa’ etc.

At the same time Visa and Mastercard cry ‘crocodile tears’ about those people left behind, reinforcing the inevitability of the digital story. ‘If we sleepwalk into a cashless society, millions will be left behind’, ‘Cashless society coming, but cash-dependent can’t be left behind’, ‘Elderly must not be left behind in move to a cashless society’ etc.

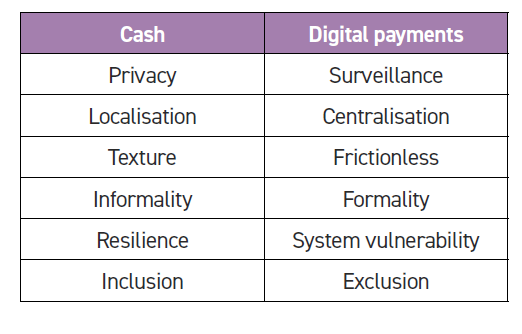

If one argues for cash in the context of the digital narrative, the chances of breaking through are significantly less than if the debate is reframed. Key ideas lie in autonomy compared with dependence, public infrastructure v private infrastructure and the broad limitations of a digital world. If one talks about cash as the bicycle of payments, the conversation changes.

A building with emergency stairs has been built with necessary critical infrastructure. It is not old fashioned or left behind.

If you ask whether people really want big corporate business involved in and knowing about their informal relationships – tipping, rewarding buskers, paying into honesty boxes, gifts to children etc. – the conversation changes. Cash is private, informal, local, real.

If you enable access to all with a payment method that cannot be blocked or does not require infrastructure, that method is modern, efficient, safe, resilient and inclusive.

The conference room split into working groups to see if they could devise a billboard, social media campaign or guerilla marketing campaign to present cash as a positive choice without falling back into a defensive crouch shaped by the war on cash.

It was a fascinating exercise which revealed real creativity, ranging from Banksy style artwork with cash presented in the image and a Tik Tok series of clips showing cash being used in situations where only cash works well. Potential slogans such as ‘Cash: more than a beer token’ and an image of Visa’s annual profit and the line, ‘nothing is for free’ do not make the public space! They should.

Coincidentally, Chris Skinner, author and commentator on financial markets and fintech, recently asked the question: when do we need physicality? His answer was:

‘We need physicality today for human connectivity. We need branches for trust and marketing, not for service and advice, and we need cash for anonymity and immediacy, not for payments. There is still a role for both in our digital world or, at least, there is a role until trust, marketing, anonymity and immediacy are replaced by something else. Something that the authorities cannot track and trace. 1’

Perhaps the takeaway is that whenever we think and talk about cash, we need to argue that it is in fact modern, efficient and safe. We need to focus on its ‘humanity’, that it connects us all through its informality and texture, and that it’s privacy, localisation and resilience offers something that is useful and valuable.

1 - Are we cashless and branchless now? – Chris Skinner’s blog (thefinanser.com).