The Banque de France issued a working paper in October 2022 that dealt with a number of fundamental questions about cash, questions that are particularly important in a less cash scenario 1. The paper addressed not just why people hold cash but why they hold different denominations. As the economy changes, what happens to cash holdings?

The paper looks at cash demand between the launch of the euro through to the end of 2019. It used 2019 to avoid the distorting effects of the pandemic. The analysis is complicated by France being a part of the Eurosystem, but it uses a range of approaches to understand demand for different denominations, the different motives for holding cash and the role of foreign demand for cash.

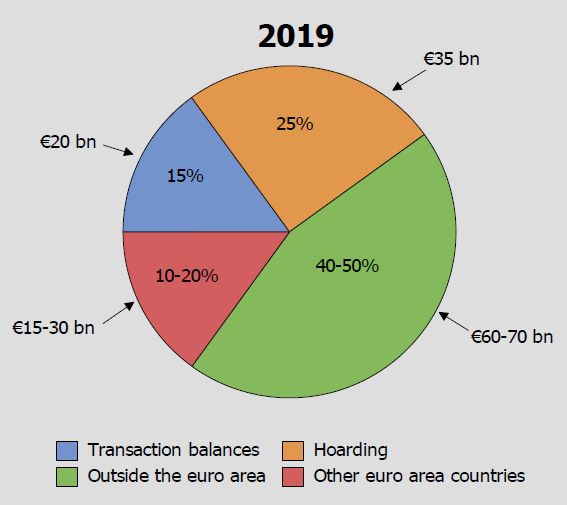

At the end of 2019 15% of France’s cumulative net issuance was being used for domestic transactions, slightly lower than the Eurosystem average of 20%. 25% of cash was hoarded for domestic purposes. 60% of issued cash was held outside of France, whether in other Eurosystem countries or outside of Europe.

In 2002 France had issued €30 billion face value of euros. By the end of 2021 this figure was €185 billion. As a proportion of GDP, the value had increased three times.

For the purpose of this study the €5, €10 and €20 were regarded as low denomination notes. The €50 was a medium denomination note used largely for transactions but, for some, as a store of value note. The €100, €200 and €500 were seen as large notes since they are not issued from ATMs and are used to store value.

The study applied indirect methods using characteristics of demand transactions compared with cash balances held for other purposes. It applied seasonal methods using ‘seasonal pattern of banknote’ characteristics to filter out information about banknotes in circulation not used for transactional balances in France. The assumption behind the seasonal approach is that non-transactional demand has little or no seasonality.

It looked at the number of transactions at the point of sale (POS) in 2019. There are significant variations across Europe. In Southern Europe, Germany, Austria and Slovenia, cash still accounts for 80% of transactions. In the Netherlands, Estonia and Finland the figure is 35-48%. In France the number of transactions at POS is 59% and the value 25%, somewhat lower than in other European countries.

The study looked at the number of annual card payments per person across Europe. Again, there was significant variation. The lowest figure was in Italy, 60 transactions, and the highest in Finland, 350 transactions. The figure for France was 220 transactions.

In France the average value of cash payments at POS was €12.30, one of the lowest figures in Europe. Cash held in wallets was €45, somewhat lower than the euro average of €76.

A study of the shadow economy in France showed that it has been decreasing in importance, particularly in the last few years.

The study tested a large number of variables reflecting various motives for holding banknotes and tested them for statistical and economic significance.

Variables for all cash transactions: total private consumption, retail sales, GDP and house price index

Opportunity cost of holding cash using different levels of interest rate: money market rates, bank deposits, ten year government bond yield

Alternative means of payment and financial innovation: the volume and value of card transactions, the volume and value of contactless and mobile money payments, the number of POS terminals (as a proxy for acceptance), the number and value of POS transactions, the volume and value of cheques (important in France, where 6.4% of payments are made using cheques compared with a European average of less than 2%) and modelling access to cash via the number of ATMs

Shadow economy: the size was estimated using causal variables such as the unemployment rate, the corruption perception index and different direct, indirect, household and business tax variables

Demand for cash from outside of France, defined as from the euro area and ‘abroad’

Precautionary and uncertainty related motives: to account for financial, economic and geopolitical tensions, the French consumer confidence index, the volatility index of the CAC40 geopolitical risk index, European news, the financial news index for France and a measure of geopolitical uncertainty applied to France were used.

A step dummy was applied for the financial crisis of 2008. The data was adjusted quarterly rather than seasonally.

Demand for the small and medium denominations have increased, but the demand for large denominations, particularly since 2014, has decreased. Net issuance of the large denominations has been negative since 2018 and France has been a net importer since mid-2013.

Cash demand equations revealed:

Different domestic and foreign motives for holding cash play an important role determining France’s net issuance

Low and reducing transaction balances.

In contrast, internal hoardings, as well as holding outside the euro area, are increasing.

In the last few years foreign demand has been driven by small and medium denominations.

The decreasing share of cash in transactions suggests active circulation is decreasing in France. The demand of cash from outside of France has over-compensated and explains the continued increase in net issuance of cash in France.

The result is that cash logistics, distribution, withdrawals and depositing behaviour are all less intense. This is driving change to France’s cash cycle and lies behind France’s National Cash Management Policy (NCMP). The NCMP is focusing on access to and acceptance of cash, the quality of cash and the robustness and efficiency of the cash cycle.

The paper concludes with three thoughts:

What happens to the store of value function of cash if transactions fall? What will be the payment preference of economic agents if digitisation continues to increase and what happens if cash volumes fall so low that cash is no longer profitable?

What happens if there is high inflation and high interest rate levels? If both are long lasting, the paper concludes that other than moving the denominational boundary and requiring a new high value, there will be little impact on transactions due to the key role of foreign demand for notes and domestic store of value.

CBDCs it regards as an imperfect substitute for cash. As a result, co-circulation is possible and that there may not be strong demand for CBDCs.

1 - ‘Different Motives for Holding Cash in France: an Analysis of the Net Cash Issues of the Banque de France’. Franz Seitz, Lucas Devigne, Raymond de Pastor. Banque de France WP 888.