Ross MacDiarmid, Executive Director of the Mint Directors Conference (MDC), hosted Professor Pasquale Sgro, Professor Franz Seitz and Guillaume Lepecq 1 to consider the question in the title, under the banner of ‘no such thing as a free lunch’.

Opening remarks covered the broad spectrum of costs of each, with Franz demonstrating that the assumptions and scope of the studies determine the answer when you ask how much payments cost. Guillaume reminded the audience of the important role cash has in making digital payments work.

The discussion ranged across why the cost of payments is not discussed through to will CBDCs solve the weaknesses of digital payments? It ended with a discussion about how cash and digital could work together.

Economist Pasquale Sgro started by outlining some of the perceived weaknesses of cash – risk of crime, encouraging the black economy and corruption, and the work and risk for retailers and businesses having to handle, store and deposit cash. The digital audit trail was suggested as a deterrent to these, as well as allowing easier cross border payments and better control of spending through the presentation of data by modern apps.

He then touched on the risks of digital, including risks to security, privacy, resilience and inclusion. Around inclusion he outlined the need for financial education, infrastructure and the need for people to have a choice. Finally, digital money is not a good store of value for those emergency situations.

Franz Seitz laid out academics’ approach to studying the cost of cash. He presented the topology of payments with private costs consisting of internal (labour and capital costs) and external costs (fees to other sectors), and resource costs consisting solely of internal costs.

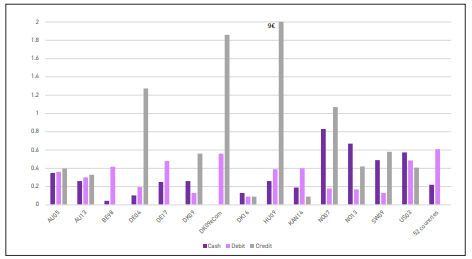

Private costs of consumers (per transaction, in €) Source: Krüger & Seitz (2022), forthcoming.

Private costs of consumers (per transaction, in €) Source: Krüger & Seitz (2022), forthcoming.Simplistically, the single most influential assumption is whether people’s time is included or not, ie. the time taken to go to an ATM, time to reconcile tills or travel to a branch to deposit money etc. The negative externalities, such as the facilitation of money laundering and environmental costs, are seldom included.

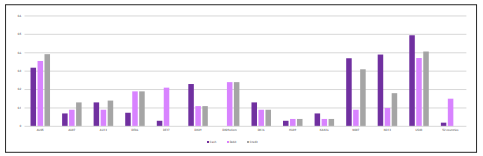

Resource costs of consumers (per transaction, in €) Source: Krüger & Seitz (2022), forthcoming.

Resource costs of consumers (per transaction, in €) Source: Krüger & Seitz (2022), forthcoming.To illustrate the importance of those assumptions, Franz shared a chart that showed a range of studies of the cost of payments over time comparing cash, debit and credit cards. The variation in the conclusions demonstrates the challenge of determining and discussing this topic.

He then shared the results of an estimate on the cost of an ATM withdrawal in Germany in 2019 based on two different methods. One used a representative wage rate to calculate the time costs, the other an economic model.

The first showed total cost of €2 billion for two billion transactions. The second a cost of only €0.11 billion. In the first example, these costs would dominate the total costs of cash, in the second they would be negligible.

Finally, Franz referred to the Dutch National Bank environmental comparison of cash and debit cards. This found that when the results were scaled relative to their respective economic values, the impact on climate change of the cash and debit card payment system are of the same order of magnitude.

Guillaume Lepecq laid out why cash is important, starting with the fact that the cost of cash is competitive in almost all scenarios. It is, of course, more than a payment tool, an important societal role. A key one is acting as the benchmark against which everything else is measured, and in doing so, offering choice if private sector costs rise too much.

A McKinsey study suggested that global payment revenue in 2019 reached $2 trillion, about 2.2% of global GDP. More importantly, they have been rising by 7% a year. Without cash, what would have happened? He also made the point that it is not how much does the payment cost, but ‘who pays’?

As with Pasquale, Guillaume raised the issue of the costs of payment fraud and financial illiteracy.

Guillaume finished with a slide about possible levers to improve the efficiency of cash – removing regulations and policies that make cash less efficient, harnessing the power of CashTech and increasing cash volumes.

The discussion that followed raised issues such as…

It is wrong to talk about costs if you don’t then also talk about the benefits.

Why isn’t the cost of digital payments discussed? Because the consumer is unaware of the financial costs, they don’t make informed decisions. Cash is taken for granted and, therefore, its wider strengths are not valued or appreciated.

What are the hidden costs of cash and who pays them? The panel struggled to answer this and perhaps it is the strengths of digital payments that reveal the weaknesses, and in a sense, therefore, the costs of cash – for consumers, convenience and the ability to earn points. For businesses, less theft by shop staff, less time in reconciliation, access to detailed customer data.

The audience were polled and asked what was important when paying from a range of options. In both their personal and their business lives, the top three were convenience, security and cost. The method of payment was not described.

What are the hidden costs of digital and who pays them? The list is long (cost, privacy, crime, resilience, debt and budgeting, inclusion, store of value, concept of money etc). When it comes to who pays, the costs are invisible or not thought about, but they fall disproportionately on the poor. The costs are proportionately greater for the least well off – they face a real challenge of budgeting and avoiding debt, are at higher risk of crime and are most likely to be excluded from the digital financial system.

This led on to when does society trump the individual? Should the state intervene to ensure societal good? Hard questions to address.

Towards the very end of the webinar the question how do you store value in a cashless world was touched on? Followed by to what extent does a Central Bank Digital Currency (CBDC) solve the weaknesses of digital payments? The claim is that they will be lower cost than today’s digital money, that they will offer more privacy and they will address the challenges of financial inclusion. There was little time to discuss this but some doubt that CBDCs will address even these problem areas.

An interesting session, an important topic. The next MDC webinar will be in November considering sustainability. Full details to follow.

To review a recording of the webinar, visit www.bigmarker.com/reconnaissanceintl1/Cashless-v-Cash-the-Hidden-Coststo-Consumers-and-Society.

1 - Respectively, Chair in Economics, Deakin Business School in Melbourne. Professor of Economics at Weiden Technical University of Applied Sciences. Chair at Cash Essentials.