In April 2020 Harro Boven and Peter Wieters published a Dutch National Bank (DNB) Occasional Study on the objectives, pre-conditions and design choices for Central Bank Digital Currencies (CBDCs). Harro wrote an abridged version that was used in Payers December publication about CBDCs which is summarised here.

A general purpose CBDC is a digital currency, issued by the central bank that is universally accessible.

A CBDC joins cash and reserve accounts at the central bank as a form of central bank money. The paper suggests three potential rationales for CBDCs:

To play a role in retaining public money for general use,

As a back-up against the failure of critical infrastructure in the payment system (although this requires the CBDC to be set up on infrastructure that is separate from the normal payment infrastructure. This has significant cost implications.),

To cater for the preferences of the public related to privacy and the use of data for public objectives (eg. Anti-money laundering).

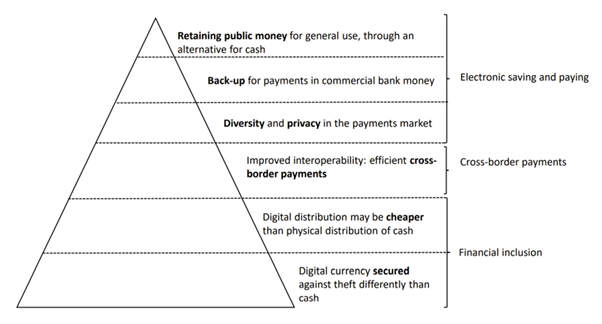

The Occasional Study goes further including discussion of cross-border payments and financial inclusion, as shown in this figure.

If the value of a CBDC is locally stored on a wallet or card, it runs the risk of being hacked or simply being lost and it could be used for money laundering since there is no centralised control of the system and a lack of identity connected to the device. As a result, for large scale schemes most central banks are looking at value held in accounts, requiring a ledger with balances and transactions denominated in the CBDC. The most common model is for the central bank to manage the infrastructure, including setting standards and managing security and solidity, and for intermediaries to access the core ledger through Application Programming Interfaces (APIs). This could include the private sector managing identity, authentication, and validation.

The intermediaries would be regulated operators. This would work in a similar way to access to a payment account by third-party operators as currently regulated by the revised Payment Services Directive 2 so that the regulated operators compete to offer customer’s convenience and drive demand for the CBDC.

CBDCs also bring their own risks, including:

Bank runs. If an event causes the public to need to safeguard their money, it is quicker to move digital currency than to withdraw physical money. The speed and scale of movement to a CBDC and a central bank account could be significant destabilising the financial system,

CBDCs could affect the funding base of banks by substituting bank deposits, which could increase banks’ dependence on market funding. This might make banks more vulnerable to unexpected market conditions,

Banks cross- sell higher value mortgages and loans based on the relationship they have with customers through their accounts. If customers move their accounts to the central bank, this could reduce their profitability jeopardising banks’ ability to meet their prudential obligations.

It would be possible to design CBDCs with a publicly desired level of CBDC holdings, using quantity and price to manage this, or an absolute ceiling.

The article concludes by stating that a CBDC would involve a structure reform of the monetary system, not a quick or trivial task. However, given that digital technology is so prevalent and normal in society, it is important that a relevant public form of money continues to be available. A CBDC is a realistic option to deliver this requirement.