At May’s Currency Conference the Bank of Thailand’s (BOT) Anak Somkanae, Senior Director, Payment Infrastructure and Services Strategy and Development Department, presented on cash logistics and its significant carbon footprint and. Separately, Montira Pattanakul, Senior Director, Banknote Operations Department took part in panel discussion on the cash product from cradle to grave. These two sessions gave an excellent overview of the BOT’s cash operations.

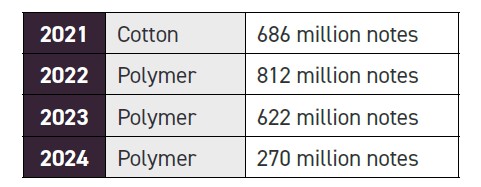

The BOT uses sustainable cotton in its banknotes and has converted its 20 baht note to polymer to benefit from the longer note life. The impact of this change is apparent in its production volumes:

Polymer issuance is expected to settle at 200 million notes per year.

Based on printing 400 million notes per year, BOT produces 3,500 tonnes of CO2e per year. It has installed 1MW of solar panels at the print works and a further 760 KW at regional locations.

BOT regulates commercial banks and CIT companies. It checks all notes before destruction. As part of its regulation, it checks small cash centres once every three years to assess their machines and standards. It also samples returned notes from cash centres – fit, unfit and mixed batches. It uses these samples to create a note quality index.

BOT has nine consolidated cash centres that carry out 30% of note processing. It also has 120 small cash centres equipped with sorting machines, such as G+D’s C4 equipment. This mix of regional and local recycling reduces the distance travelled by notes.

The consolidated cash centres are owned by the central bank and the high speed sorting machines in them are also provided by the central bank. The operation of the cash centres is tendered to the private sector and the sorting prices are negotiated with them. Sorted notes that are found to be fit are paid for, unfit notes are not. The tender was originally for a four year period. They have just been extended to a fifth year.

Notes are sent directly to the consolidated cash centres, not through the small centres. The result is that they are only sorted once.

The implementation of these consolidated cash centres has reduced the number of vehicle movements by commercial banks to the central bank by 4,900. 634 tonnes CO2e has been saved per year by reducing the double sorting of 630 million notes that used to happen.

The paper 20 baht notes deteriorated in circulation. They became so bad that the cash centres stopped sorting them.

In response to this situation, in order to encourage their return to the central bank, a ‘happy hour’ was introduced where unfit notes were not charged for, but fit notes were. This ‘happy hour’ is now permanent for the paper 20 baht.

By introducing ‘white label’ ATMs, 1,348 ATMs have been removed that were duplicating co-located ATMs, saving 2,991 tonnes of CO2e per year, 2% of the total. Overall 4,300 ATMs out of 55,000 have been removed, saving 1,008 tonnes of CO2e per year.

It is unusual to have such good data on CO2e reductions linked to policy decisions. It sends a powerful message that central banks have the ability to make a real difference by the choices they make.

BOT is able to control note quality because of its regulatory authority, its programme of checking machines and sorting on site, its sampling regime and because it tests all notes sent to it. The ‘happy hour’ has resolved the 20 baht paper note problem.

BOT captures serial numbers and so can track the issue and destruction date of notes. It samples notes and so can track quality by age.

These factors allow good quality management across the cash cycle.

As cash volumes decline, if the state decides that cash must continue to be available, then some of the costs of cash will need to be paid for by the state. The decision of the Netherlands, Belgium, Sweden and Germany to invest in new cash centres are examples of cost sharing (the Swiss National Bank has just bought land to do the same thing).

The BOT’s approach of paying for infrastructure but then harnessing the competitive energy of the private sector to run the consolidated cash centres is an interesting variation on the same theme. There is much to learn from others.