This year Microsoft turns 50. Amazon is just over 30, Meta is 21 and the iPhone is just 18. Another organisation turning 18 this year, one that has had a major impact on payments, is M-Pesa. Payments:Unpacked 1 recently ran an article from Jeremy Light’s Agenda:Payments newsletter 2 celebrating M-Pesa’s milestone birthday.

M-Pesa was launched on 6 March 2007 by Safaricom in partnership with Vodafone to facilitate microfinance, internal remittances and selling mobile phone airtime. M-Pesa was a success from the start in Kenya and today has expanded across Africa.

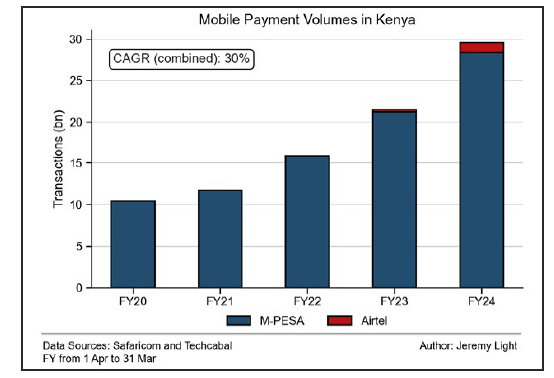

By late 2009 it had 8.3 million registered customers, 57% of Safaricom’s customer base and 21% of Kenya’s population. Last year the Central Bank of Kenya (CBK) recorded 82 million mobile accounts, predominantly M-Pesa, in a population of 56 million. For the financial year 2023/24 the value of transactions was 40 trillion Kenyan shillings (KES), equivalent to $309 billion, across 28 billion transactions. Credit and debit card volumes were 61 million payments in the same period.

To put this in an international perspective, in terms of annual real- time and mobile payments, there were 527 payments per capita in Kenya compared with 355 in Thailand, 266 in Brazil and 119 in India.

The author found that most countries seem to have around 650 total annual payments per capita across all payment methods. The mix varies according to local circumstances. If this is applied in Kenya, then only 19% of all consumer payments are in cash. The reported figure is 80%, so there is a disconnect here 3.

In 2007, only 26% of Kenyans had a bank account and bank branches were few and far between outside of cities. Cash was King. With M-Pesa, using basic feature phones (USDD/ SMS), cash could be deposited with an M-Pesa agent who sent a code by text to the recipient. The recipient walks into any M-Pesa agent near them and gets the cash on presentation of the SMS. Safaricom credits the agent’s M-Pesa account, plus a commission. To do all this, consumers and businesses needed a registered Safaricom SIM on their mobile phone.

M-Pesa’s fee structure was set so that it was worth consumers paying the fee compared to taking a day off work and/or paying a bus or taxi driver with a material risk of loss. The average fee for chargeable transactions is 0.62% of transaction value.

The agent network was, and is, a key pillar of the success of M-Pesa. Safaricom had a network of agents selling airtime and this network became M-Pesa agents. A mix of fee income and additional customer footfall into the agent’s retail outlets incentivised them.

M-Pesa also has a mobile app on smartphones and in 2023-24 3.6 million of the 32 million active users had the app. There are also 142,000 active business app users.

633,000 agents use the Lipa na M-Pesa business service to accept M-Pesa payments in their retail outlets. There is also the ‘Pochi la Biashara’ M-Pesa wallet for small businesses, which allows motorcycle taxis, food vendors and kiosk owners to get paid.

After initial resistance to M-Pesa, banks are connected into M-Pesa and M-Pesa accounts (wallets) for a full range of transactions and uses, all in real-time. These include walletto-wallet, wallet-to-bank, bank-to-wallet, online and in-store, ATM withdrawals and bill payments. Even though M-Pesa does not require users to have a bank account, almost 85% of the adult population in Kenya now has one.

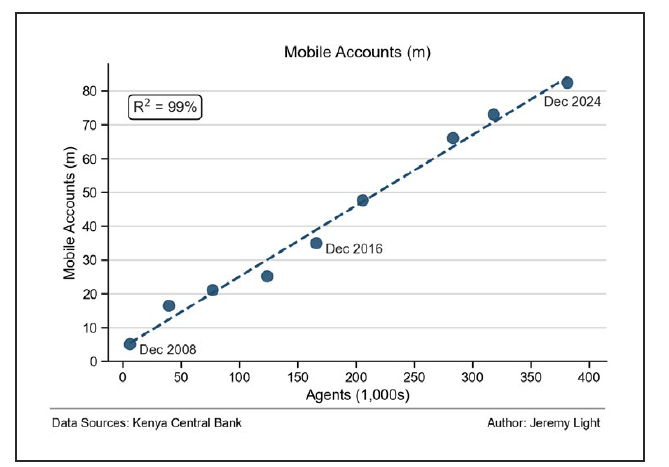

CBK has established a linear relationship between agents and M-Pesa accounts. Over the last 18 years each agent has averaged about 225 mobile accounts. The number of agents has grown to over 381,000 agents and 82 million mobile accounts as of December 2024.

One of the challenges M-Pesa faces is that while the volume of transactions has risen, the value has fallen. In 2020, the average value was KES 1,898 ($14.68), in 2024 it was KES 1,420 ($10.99). This means agents are earning less.

The CBK monitors and publishes the volume and value of M-Pesa cash-in/ cash-out transactions, to keep track of liquidity requirements.

In recent years, the proportion of all transactions that are cash-in/cash-out transactions has fallen, even though these type of transactions are growing still. This suggests that the use of M-Pesa for digital payments is growing even faster.

Initial success. A mixture of timing and parentage have been significant factors. There was a need to improve cash remittances in Kenya, and Safaricom had both an 80% market share of mobile telecoms and an established agent network across rural and urban Kenya.

The business plan was realistic – with the fee structure priced low enough not to deter consumers but high enough to satisfy merchants. It was designed to allow small and large businesses to use it, as well as person- to-person payments. Its instant notification of payment by SMS built confidence and made it practical for use in commerce. Additionally, M-Pesa worked without needing a bank account and, in due course, was deliberately bank-agnostic.

The commercial banks bought into the benefits of M-Pesa, and so didn’t fight it, and the central bank allowed M-Pesa to operate with light regulation as a telecoms payments network rather than under bank rules. It saw the beneficial impact on internal cash remittances and so was willing to ignore initial bank lobbying and objections to M-Pesa.

That M-Pesa was Kenyan, built and designed for Kenya, also delivered a sense of ownership just as Pix and UPI have in Brazil and India.

Current success. Subsequent success has been possible because M-Pesa has been able to scale fast and predictably. In addition, Safaricom has always made M-Pesa a priority in terms of investment and expansion of the agent network. It has focused on growing M-Pesa as a financial ecosystem rather than a product, and has aligned technology development, pricing and regulatory engagement with this in mind. It has built M-Pesa as a brand which is now widely recognised in Kenya and globally.

Future success. M-Pesa’s roots are facilitating the transition from cash to digital payments, working seamlessly with both, giving consumers choice and control. It now supports all payment types: wallet-to-wallet, walletto-bank, P2P, B2B, bills etc. M-Pesa is an all-in-one payment service that caters for most payment needs, although different user types have different payment limits. It is now being expanded into a super app for wider financial and other services.

M-Pesa is not dissimilar from other successful mobile real-time payment systems such as iDEAL (Netherlands), Pix (Brazil) and UPI (India), but it has achieved its success over 18 years through a unique route. In terms of annual payments per capita, it is far ahead of most, possibly all, by a wide margin.

It does, perhaps, indicate the direction of travel for the world’s payment systems – mobile, real-time payments, with wallets, working with and without bank accounts. Many could learn from what Safaricom and Kenya have done.

1 - Payments:Unpacked

2 - Agenda: Payments | Jeremy Light | Substack

3 - Popular payment methods in Kenya 2024: Cash and M-Pesa lead the way