There will be very few organisations that can eliminate carbon emissions completely, and most organisations are going to take a number of years to get anywhere close.

A solution is to offset those carbon emissions while changes are made. Carbon offsetting can be a daunting prospect where trust and confidence is lacking. At the Cash & Payments Sustainability Forum™ in November a presentation by THG Eco provided clear guidance on what is involved and what has to be got right.

THG Eco is active in most sustainability areas from measuring carbon footprints, carrying out Life Cycle Assessments, net zero road mapping, Science Based Target Initiative submissions and reporting etc. Regarding carbon offsetting, in addition to issuing and retiring carbon certificates, it issues renewable energy certificates, carbon neutrality certificates, direct carbon project investment and pre-feasibility assessments and runs tree planting and corporate planning days.

It starts with somebody identifying and designing a project which meets the criteria to be recognised as certifiable, and therefore with a value, as a carbon offsetting project.

That project must now be validated. For a project to be validated it must be:

Real. Did it actually take place?

Measurable. Using recognised tools and techniques within standard margins of measurement error and with leakage taken into account.

Additional. ie. it would not have taken place without the help of carbon finance.

Independently verified by experts who know that country and that sector.

Unique. Double counting is avoided using registries that track ownership and the cancellation of credits.

Once validated, the project can be developed. The developer then measures and reports the emissions, and this is validated by an independent third party. This then allow the offsets to be issued and traded. Once purchased, the offsets are retired and this needs to be recorded so that they can’t be reused.

Carbon credits are government-issued carbon allowances. In order to buy and sell them there needs to be an Emissions Trading Scheme (ETS) but these are relatively rare. In the US, for example, only California has a state-administered carbon trading programme.

Carbon offsets are carbon credits traded on the voluntary market. 124 countries now have registered carbon offset projects. Offsets don’t fall under existing government regulations.

In the absence of a government regulator, third party verification is used. THG Eco use one of three credit standards and mentioned two more.

UN Framework Convention Climate Change – Certified Emissions Reduction

Gold Standard – Verified Emissions Reduction

Verra Verified Carbon Standard (VCS) – Voluntary Carbon Unit

The additional two were the American Carbon Registry and the Carbon Credit Cart.

When looking at carbon credits, they should come with information on the credit standard they are registered with, the unique project identity, where the project is, the methodology used (project type) to calculate the credit, the year the offsets were generated (the vintage), features (eg. SDGs (Sustainable Development Goals), CCBs (Climate, Community and Biodiversity standards), CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation)), the volume measured in tonnes and the unit price per credit.

The standards should provide third party monitoring around the world, the infrastructure to issue, trace, transfer and retire credits and evidence of ownership to prevent double counting.

Credit retirement is used to retire or transfer offsets stating the reason for cancellation. A record of the retirement is held in the public domain on credit registries.

Avoidance. In 2021 90% of credits were avoidance credits, credits issued for projects where a cleaner alternative was created than the otherwise most likely course of action. For example, if the investment was in renewable energy sources rather than a coal power station.

Removal. Removal credits are for investments that directly sequester carbon from the atmosphere and stores it in a system. For example blue carbon (mangroves), brown carbon (soil carbon, biochar) or direct air capture.

While removal credits have remained at about the same level below 20 MtCO2e per annum since 2015, avoidance credits have increased rapidly, from 20 MtCO2e in 2016 to 130 MtCO2e in 2021.

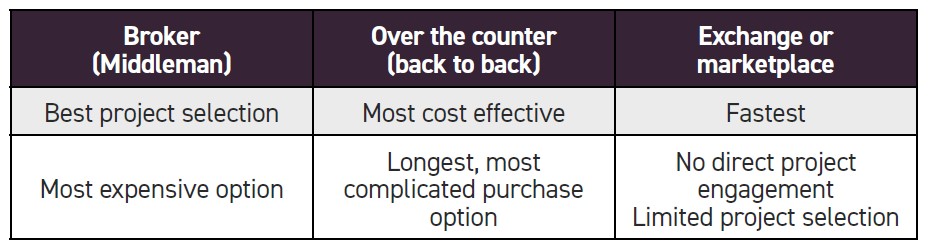

There are three main ways to buy carbon credits, each with their own strengths and weaknesses.

The issuance and retirement of carbon credits was almost balanced from 2015 to 2018, with only 2017 seeing a small excess of issuance over retirement. In 2019 that changed. More carbon credits have been issued than retired since then.

The difference was 10% in 2019 on a retirement level of 71 million offsets, 30% in 2020 on 94.4 million, 61% in 2021 on 162.4 million and 51% in 2022 on 112.8 million.

By 2030 the forecast is that supply will exceed demand by four times and this will persist.

The price of carbon offsets measured in dollars per tonne increases relative to how ‘additional’ the carbon offset project is.

In 2020 transport, energy generation and energy demand projects had the lowest price, being around $1/tonne. The value increased through chemicals and waste through to nature based solutions with a price of $6/tonne. The average carbon offset price was $2.50.

These prices have not changed much since then.

Unregulated markets require care. Inevitably there are organisations who use the uncertainty and complexity of this topic to their own advantage. This presentation shone a welcome spotlight on to the topic and demonstrated that following the mantra ‘measure, reduce, offset’ can be done safely, ethically and with confidence.