Jens Eberhardt, Managing Director of Cashinfrapro, has written a useful paper – ‘Green Cash Logistics’ – which considers how modern ways of working can reduce the environmental impact of the cash cycle.

The cash cycle involves a wide range of participants and few of the benefits outlined are achievable by actions taken in isolation. The paper argues, therefore, for end-to-end change enabled by central banks through regulation, and for cash customers to work with cash providers to ensure the full benefits of change can be achieved.

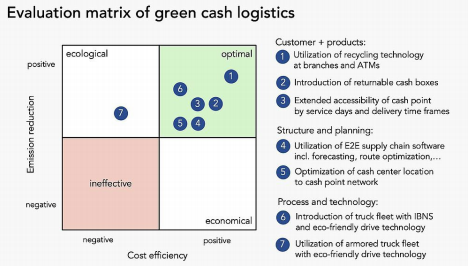

If cash recycling technology was introduced at bank branches and ATMs and combined with cash forecasting and dynamic route optimisation software, it would be possible to reduce the stop frequency and the distance between stops for cash in transit (CIT) vehicles and the inventory at each point where the cash is held. Direct cash exchange between places which hold and need cash would increase this even further.

Depending on the size of networks, the extent to which customers sites are clustered together and the cash volumes, improvements of as much as 40% have been seen through such changes.

It is possible to optimise packaging systems based on returnable boxes. For this to be successful there needs to be software to manage containers and boxes. The boxes need either to be ‘connected’ to a database to manage the process and/or to be ‘tracked’ or to be tamper-proof controlled with/over electronic seals.

When this is combined with standardised formats for box identification, such as GS1 Standards, then data capture and exchange is straightforward and the full benefits of logistic software tools can be accessed.

The returnable boxes offer the opportunity to automate cash centre storage and retrieval systems, including conveyers, automated guided vehicles and truck loading/unloading. Usable boxes need to be tamper proof, robust, able to be handled manually (weighing 15kg) and automatically. This limits the box size holding to 10,000 notes.

All this allows the recirculation rates of and investment in cash boxes to be optimised; it eliminates the loss of boxes, reduces the costs of empty box handling and avoids auxiliary costs of alternative packaging.

With all this in place it is possible for returnable boxes to be used for all ATMs (with cassette swaps), 70-85% of bank and even 50% of coin deliveries/pickups for retail shops. The shop figure is possible where coin exchange is driving cash demand.

Mature supply chain software can support enterprise-to-enterprise (E2E) logistics. The software is capable of allowing order placement using web-based platforms, managing deposit processing and enhanced analytical practices through cash forecasting tools.

But such tools have to be supported by change of logistic/operational processes. For example, forecasting tools can reduce cash inventory and the frequency of stops that a CIT vehicle must make, but if it is to do this and to maintain service levels, it needs to be combined with dynamic route planning and execution.

Making such changes needs more than a vision, an analysis of the gap between the existing situation and the desired end state and a plan. It needs a real focus on the future and that change, once started, will be continuous.

Digitisation will need organisations to accept that the old ways may be abandoned completely, ‘no-regret’ improvements as the paper describes it. The plan must look at the end-to-end processes, including whether the organisation’s structure is set up to support continuous improvement. The software and processes need to anticipate the need for future upgrades.

The average city delivery route for a CIT vehicle is less than 150 km, making it well suited to electric vehicles. Unfortunately, many cities limit the weight of vehicles allowed, typically to 3.5 tonnes. Batteries are heavy and it is likely the weight of loads that can be transported will reduce by up to 300 kg. The extra journeys this is likely to require cancels out the benefits of going electric.

Either lightweight composite armour is needed, or CIT companies can move to Intelligent Banknote Neutralisation Systems (IBNS).

IBNS protected boxes automatically stain their contents with indelible dye in the event of a detected attack or fraud. They have proved to be highly effective and reliable against attacks. As a result, some CIT companies use them in vehicles that are not armoured (and have reduced their crew sizes since the vehicles don’t need to be ‘defended’ in the same way). This means that electric vehicles are viable.

Central banks play an important part in enabling the investment in change required.

Clean note policies are needed to enable and encourage banknote recirculation.

The central bank’s cash centres need to re-think their cash services, accept and support changes to packaging systems and require the use of standards that allow interoperability, for example electronic data interchange and data capture.

The cash cycle post-issue accounts for some two thirds of the environmental impact of cash. Much of that impact is due to inefficiencies at cash centres and transporting cash. Poor cash management combined with fixed routing schedules can lead to emergency orders, late deliveries and extra journeys and routes. Poor planning data and tools can cause excess cash inventory, waiting times at shipping bays and lost times in processing. Higher costs and missed quality levels result.

Encouraged and enabled by central banks and a wide industry awareness of what is possible, cash cycle stakeholders can invest to deploy modern technology to reduce inefficiencies, achieving better service levels, lower costs and a lower environmental impact.