The latest Bank for International Settlements (BIS) Innovation Hub has been opened by the Federal Reserve Bank of New York, joining Hong Kong, London, Singapore and Switzerland. The role of the Innovation Hubs is to validate, design, build, and launch new fintech products and services for the central bank community. The public and private sectors will work together focusing on supervisory and regulatory technology; financial markets infrastructures; future of money; open finance; and climate risk.

Indian media report that the Indian government has pulled back from banning cryptocurrencies outright but will regulate their use within India. In November the Finance Minister said a bill was being re-worked to cater for rapid changes in the industry.

The media are suggesting that cryptocurrency will not be recognised as legal currency but will be regulated by the Securities and Exchange Board of India (SEBI), and citizens will be required to declare their assets and refrain from keeping them on exchanges outside the country.

The First Deputy Governor of the Banque de France, Denis Beau, has spoken about the CBDCs, Decentralised Finance (DeFi) and the need for the bank to regulate this emerging sector. In his speech he talked about the impact of big tech companies, the rise of fintech and the growth of cryptocurrencies such as bitcoin, suggesting they can make digital payments easier to access, cheaper and more convenient.

On the other hand, he also commented that, ‘these innovations also carry risks for the smooth functioning of our payment system’.

One of his concerns was that because the link of cryptocurrencies is complex and fragile, if it exists at all, they ‘call into question the integrating and anchoring role that central bank money plays in our payment systems.’ The risks are that they fragment the payment system, less competition if the big tech companies exploit their monopolistic power and a security risk because cryptocurrencies have ‘unstable value, uncertain convertibility into central bank money, and [are] without a responsible issuer and credible lender of last resort in the event of a destabilizing shock.’ While CBDCs offer the benefits of DeFi without many of its challenges, even here he expressed concerns, primarily around the impact of disintermediation on commercial banks. His solution is to involve them in the development of CBDCs.

For now, the First Deputy Governor sees regulation of non-securities tokens, including bitcoin and stablecoins, as the priority for the smooth functioning of the payment system.

Palau, a Western Pacific Island, does not have a central bank but it does want to be part of the digital payment world. Since it can’t issue a CBDC, it has announced that it is exploring working with a private technology partner, Ripple, to issue a national stablecoin. The aim is to launch this in the first half of 2022 and that it will be backed by and denominated in US Dollars to allow cross-border payments.

This would be the world’s first government backed stablecoin. The President of Palau said, ‘The first phase of the partnership will focus on a cross-border payments strategy and exploring options to create a national digital currency, providing the citizens of Palau with greater financial access.’

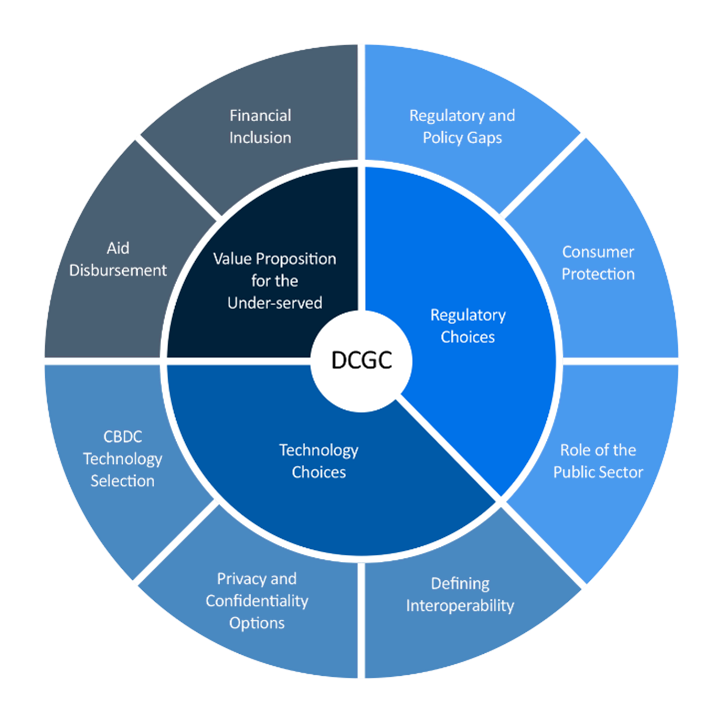

The World Economic Forum has convened a Digital Currency Governance Consortium to address key questions and governance gaps relating to digital currency. 80 organisations across numerous sectors and regions form the membership in order to:

Identify gaps and areas of further investigation for digital currency policy and governance.

Surface incompatibilities and trade-offs with respect to digital currency technology, such as financial access and compliance, and the relevant implications and consequences for users.

Co-design needed frameworks or analysis to contribute to the global understanding and responsible deployment of CBDCs and stablecoins.

Its work has focused on three streams of work, each of which has a number of subsets.

The DCGC has now issued eight papers summarising its work:

Paper 1 - The Role of the Public Sector and Public-Private Cooperation in the Era of Digital Currency Growth

Paper 2 - Regulatory and Policy Gaps and Inconsistencies of Digital Currencies

Paper 3 - Digital Currency Consumer Protection Risk Mapping

Paper 4 - What is the Value Proposition of Stablecoins for Financial Inclusion?

Paper 5 - Blockchain-Based Digital Currency and Tools for Cross-Border Aid Disbursement

Paper 6 - Privacy and Confidentiality Options for Central Bank Digital Currency

Paper 7 - Defining Interoperability

Paper 8 - CBDC Technology Consideration